The Indian real estate sector has shown impressive resilience and growth in the third quarter of 2024, recording 25 transactions that totalled a remarkable $1.4 billion. This surge is largely driven by Qualified Institutional Placement (QIP) issues initiated by developers, indicating a robust recovery and strategic positioning within the market. The quarter not only marked an all-time high in the number of deals but also achieved the second-highest total value since the second quarter of 2023, reflecting an increasing confidence among investors and stakeholders in the real estate landscape.

While the QIP activities played a pivotal role in boosting deal values, the private equity sector also contributed significantly to the momentum. Despite a considerable decline in private equity deal values from $1.4 billion in Q2 to just $0.4 billion in Q3, the volume of deals remained stable, highlighting ongoing interest in smaller, focused investments. The quarter saw eight mergers and acquisitions (M&A) valued at $51 million, along with 12 deals in the private equity and venture capital space, amounting to $401 million. This trend demonstrates a shift towards more calculated and strategic investment approaches within the market.

The heightened activity in the capital markets during this period is particularly noteworthy. The quarter featured one initial public offering (IPO) worth $49 million, alongside four QIPs amounting to an impressive $940 million—nearly six times the value recorded in the previous quarter. Notably, Prestige Estates emerged as a frontrunner in this landscape, successfully raising $602 million through QIP initiatives. This indicates that major players in the sector are proactively seeking avenues to capitalise on favourable market conditions while addressing the growing demand for sustainable and innovative real estate solutions.

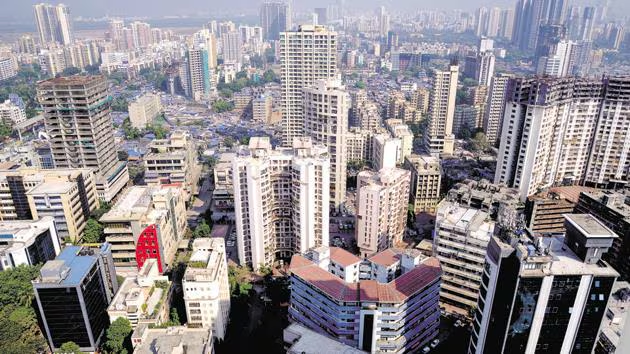

From a sustainability perspective, the influx of capital into the real estate sector aligns with the industry’s increasing commitment to environmentally responsible practices. Investors are becoming more discerning, favouring projects that emphasise sustainability and long-term viability. This shift not only enhances the appeal of properties but also reflects a broader societal push towards eco-friendly urban development. The emphasis on sustainable practices within the real estate sector is critical, as it directly contributes to civic betterment and the overall quality of life for urban residents, fostering a healthier and more sustainable living environment.